Introduction

Details

On December 26, the National Venture Capital Guidance Fund was officially launched.

Zhu Tan learned that the biggest feature of the fund is that it "invests early and invests small" in the technology field-"early" refers to those early projects with advanced financing rounds, and "small" refers to those small-scale start-ups.

Investing in these fields means investing in high risks.

In the current situation where the uncertainty of the external environment is intensifying and some countries intend to "decouple and break the chain", we have launched a guidance fund to face risks directly, which is to clearly send a signal:

No matter how the external environment changes, our pace of innovation will not stop.

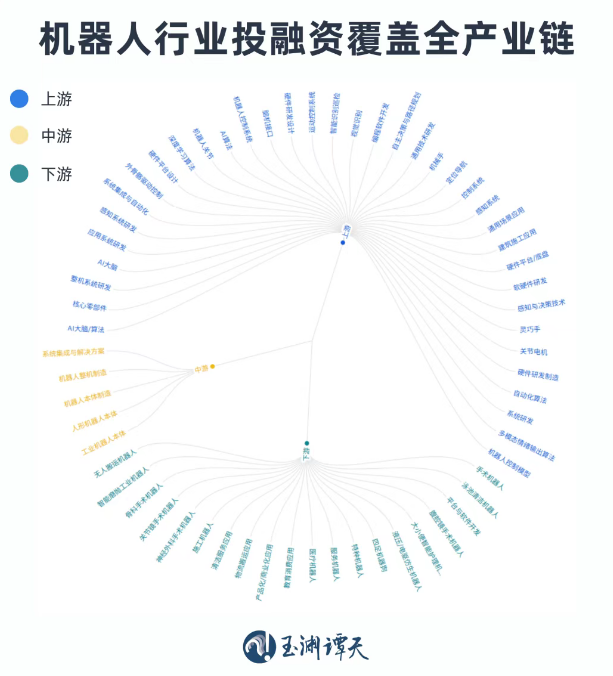

Professionals told Mr. Tan that the focus of the guidance fund is to focus on strategic emerging industries and future industries, and support original, disruptive technological innovations and key core technology breakthroughs.

As the end of the year approaches, the state drives social capital to "end" together, plan a layout in advance, and face risks first.

There are many national-level "guidance funds. The general" national-level "guidance funds focus on a certain industry or field, while the national venture capital guidance fund is more special.

According to the fundraising method, "funds" can be roughly divided into two categories.

One is a fund that publicly raises funds from ordinary people, such as stock funds or bond funds that we can buy in some apps.

The other is private equity funds, which are only open to professional institutions and "qualified investors" who meet certain conditions.

The "angel round", "A round" and "B round" we often see in related reports... are essentially non-public equity financing, and its source of funds is capital in the form of private equity.

The duration of traditional venture capital funds is usually only 7-10 years, and the distribution must be withdrawn when it expires. However, it takes longer for a technology to obtain a return on investment from concept, research and development to mass production.

As a result, most VC/PE will only invest in projects that are close to commercialization or have matured. Therefore, from a realistic point of view, there is a long-term shortage of capital to really invest in the earliest innovations.

Relevant data show that in the first half of 2025, in the entire venture capital market, only about 9% of funds flowed to early-stage investment projects. A large amount of capital is concentrated in a relatively mature stage where risks have dropped significantly.

The truly "earliest" seed round and angel round are always the most cautious links for capital.

During this period, money is most needed, but it is the most difficult to raise money.

Taking the field of biomedicine as an example, there is a saying that it often takes 10 years and an investment of 2.6 billion US dollars to develop a new drug, and the success rate is only 10%.

Therefore, the industry also calls the stage when scientific and technological innovation enterprises move from the laboratory to the market the "Valley of Death". Without long-term capital support, many technologies will not be able to go out of the laboratory, let alone the market.

Moreover, this kind of investment generally has repurchase clauses or performance-based betting clauses. With the continuous development of technology, both the amount of funds required for technological breakthroughs and the risk of whether technology can be transformed into applications are on the rise. Under such circumstances, the contradiction of "investors dare not invest, entrepreneurs dare not take" has become more and more prominent.

It is also under such a realistic background that the establishment of the National Venture Capital Guidance Fund is particularly critical.

Master Tan learned that compared with other market-oriented funds, Guiding Funds are currently most concerned about not the return on investment, but serving the national strategy.

The National Venture Capital Guidance Fund is to spend money on places that are "more short of money". For innovation, not a penny of the money that should be spent should be spent.

In the specific operation process, there are several innovations in the system design of the National Venture Capital Guidance Fund.

One is the clear requirements for investment.

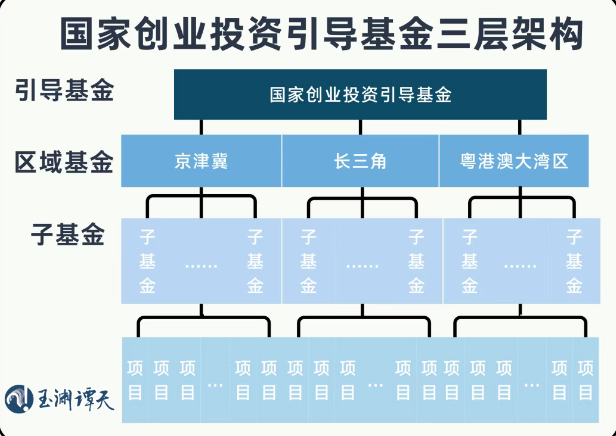

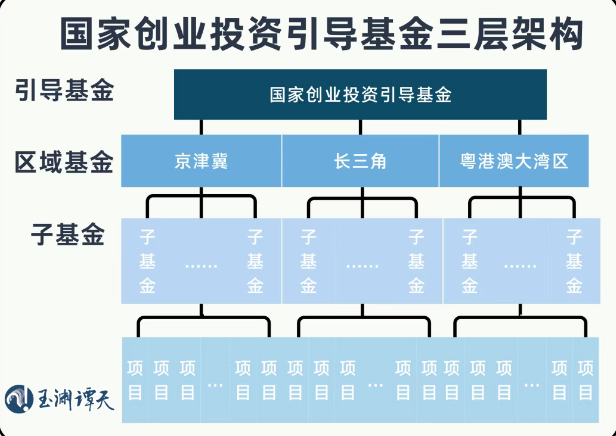

The National Venture Capital Guidance Fund adopts a multi-layer structure design of "Guidance Fund, Regional Fund and Sub-Fund". Among them, sub-funds directly invest in specific enterprises or projects through market-oriented operations.

According to the partnership agreement, at least 70% of the funds of the sub-fund must be invested in seed-stage and start-up enterprises, mainly covering the A-round financing and previous stages.

In other words, we set the "first mile" of corporate financing as the main investment direction of the fund.

The second is the innovation of duration setting.

The duration of the National Venture Capital Guidance Fund is set at 20 years, which is currently the longest duration among national funds.

Yang Ping, director of the Investment Research Institute of the China Academy of Macroeconomics, told Tan Zhu that this ultra-long cycle has sent a strong signal to the market-national capital is ready to accompany technology-based companies for "long-distance running", and social capital can really calm down to incubate disruptive technologies.

This deadline design provides time guarantee for those hard technology projects with a long technology research and development cycle and a slow commercialization path.

The third is innovation in the implementation process.

Contribute as a limited partner (LP), but do not directly participate in daily management, and fully respect market-oriented and professional judgments.

Judging from the partner structure of the regional fund, it can be said that it has gathered the most professional investment partners in China.

Zhongjin Pucheng Investment Co., Ltd., a partner of the Beijing-Tianjin-Hebei Venture Capital Guidance Fund, is a subsidiary of CICC. It has long been concerned about the semiconductor field and has invested in chip companies such as General Micro Technology and Zhongke Lanxun. | | Anhui Provincial Science and Technology Achievement Transformation Guidance Fund, a partner of the Yangtze River Delta Venture Capital Guidance Fund, has invested in more than 100 projects, covering unicorn companies such as Yuanyuan Quantum, Huasheng New Energy, Xiulang New Materials, and Haitu Microelectronics; | | Partner of Guangdong-Hong Kong-Macao Greater Bay Area Venture Capital Guidance Fund Shenzhen Guochuangyin Science and Technology Innovation Investment Partnership, its largest investor Shenzhen Guidance